Bridge Loans Options

Questions to Ask:

How fast do you need to close?

Is there an existing HELOC with money available?

How much can you add to the deal even if it is temporary?

Departing home value?

Exiting loans?

Main Players

Arrival

Flyhomes

Homelight

Knock

Departing Contract:

QuikBuy.com part of MovingStation.com

Flyhomes.com

We do the loan:

Kim Bright

Arrival Home Loans

(415) 919-6490

1555 Grant Avenue, Novato, CA 94945

(415) 726-2755

[email protected]

Cross-Collateralized Bridge

11th month balloon, Works off AVM

2.5% to borrower (1pt to me) can give a credit.

Rate: 10.5% interest only, monthly payments

We provide a rate and term refi after they close.

No DTI Restrictions, No ATR, Collateral Lender, Must Stated Income

Can go up 110% LTV of Purchase with max of $100,000 cash back. - extra money can be used for making payments/

21 - 30 Days

New Construction needs a full appraisal.

Two titles policies:

Or Refi 75% Bridge Loan Stand Alone $2,000,000 possibly more with exception and lower LTV.

Calculation:

(Purchase Price + AVM Departing Residence x 75%) less existing 1st and 2nd

Say "No" to Traditional Limits

At Arrival Home Loans, we specialize in the modern-day approach for consumer bridge loans—designed for buyers who want to purchase before selling their current home, without jumping through traditional hoops.

Here’s what we say "No" to:

No Income Verification

No DTI Restrictions

No Pre-payment Penalties

No EPOs to Brokers

No Appraisals – in most cases No Long Waits for Approvals and Answers

Instead, we offer: Financing up to 100% (or more) of the new home purchase price. Fast, flexible solutions that are built for today’s market A wholesale lending partner you and your clients can trust.

Let’s simplify the buy-before-you-sell journey together.

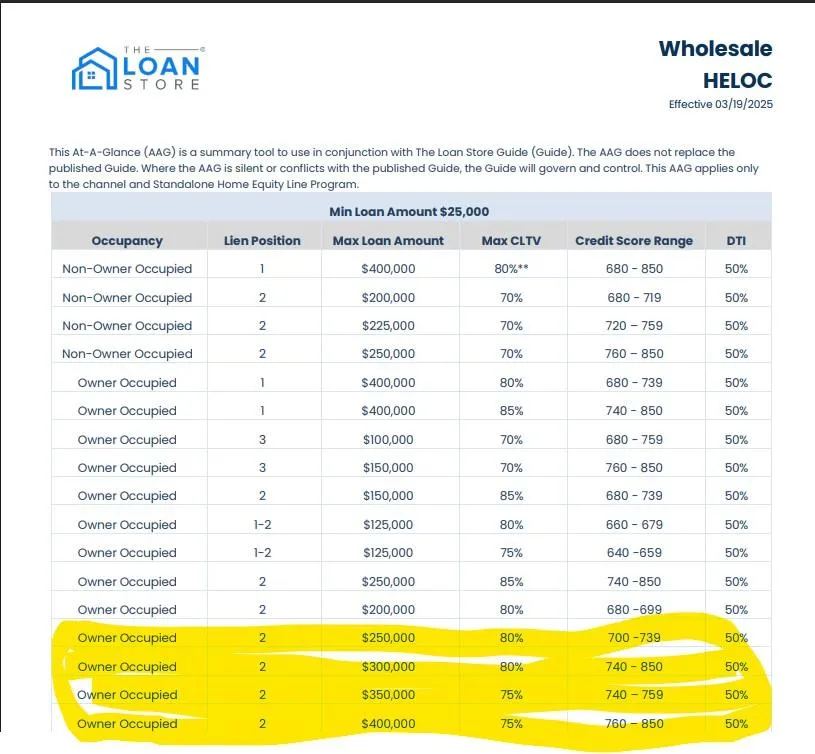

Or can cash out bridge on the departing home

75% on the departing Residence

Stated Income

No EPO to Brokers

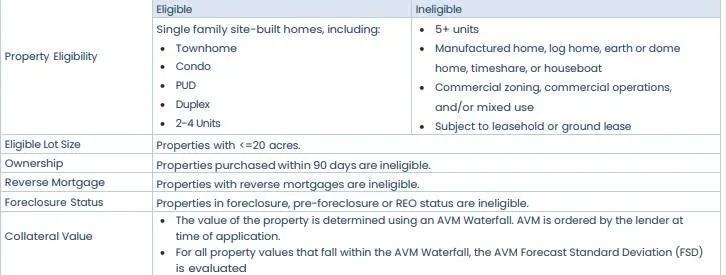

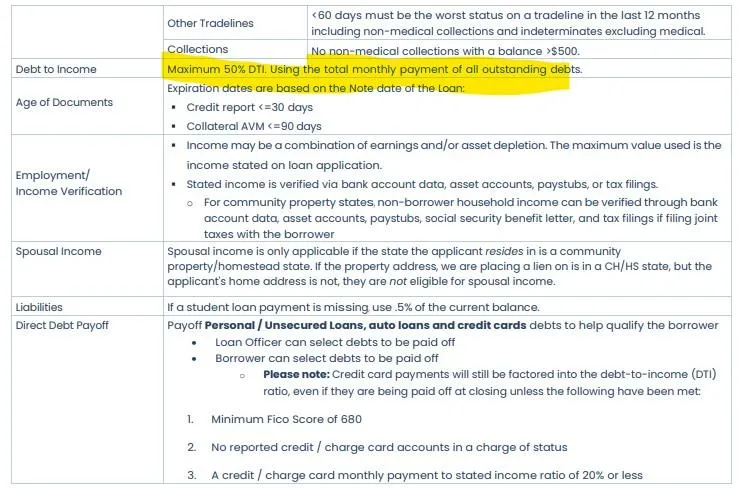

Jennifer Nealeigh

The Loan Store

Email: [email protected]

Phone: (650)619-8404

They do homelight.com or the figure.com loan

2.99% Origination Fee for homes on the market.

Liv Barton

LendSure Mortgage Corp.

(801) 739-4529 |

2750 E Cottonwood Pkwy, Ste 250

Cottonwood Heights, UT 84121

Bridge Loan is done through Homelight

Bridge Loans: "Huge for realtors – allows buyers to access the equity in the departing towards the down of the purchase without it being sold – they can put down a non-contingent offer."

The bridge loan allows buyers to access the equity in the departing towards the down of the purchase without it being sold. It also allows borrowers to make a non-contingent offer.

The bridge loan is essentially a cash-out refi. We pull out cash from the existing residence to put as a down payment for the purchase.

You can access the bridge loan calculator here: https://lendsure.com/broker-resources/bridge-loan-calculator/

For bridge loans – these are a standard 9.250% across the board. 12-month balloon payment so no monthly payments required. LendSure charges a 2.25 PT origination fee for all bridge loans. 75% max LTV on the

cash-out refi/bridge loan.

For the purchase I would need to know the following for pricing…

FICO? LTV? (80% max)

Purchase Price?

Type of property? Condo, SFR, Townhome?

What will they be using for income?

Once I know the above, I can give you a good idea on what we would be looking at for rate. This would still be a non-QM rate so it is going to be higher than conforming rates, however, the borrower only needs to stay on the

purchase loan for 8 months (our EPO) before they refinance into something conventional or long term.

This would be two separate loans. Please note that we must do both the bridge loan and the purchase loan for this program.

If full doc - $1595 UW fee on both loans. If bank statement/alternative income - $1895 UW fee on both loans.

We only hit the borrower for the payment on the new purchase loan, not the bridge loan payment (since there is no monthly payment). The borrower only needs to DTI based off the new purchase payment.

For the bridge, the borrower can pay this off as soon as they sell the departing home. For the purchase, they can use this as a band aid loan – just need to make 8 payments (for the EPO) and can refi out.

For comp, you can charge up to .5 pt BPC on the bridge loan (subject to change if we run into section 32 issues). On the purchase loan, you can charge whatever you want up to 2.75 pts BPC.

Departing residence must be listed on the MLS prior to closing and must be sold within the 12-month period.

All bridge loans require approval from senior management.

The next step would be submitting the file for a preapproval. This not only reassures the borrower they have a solid approval to move forward if approved, but it also significantly increases the speed and efficiency in the formal

underwrite and our ability to move to a formal Conditional Approval with limited conditions to get at the point of CD, docs, and funding. Average times between disclosures and funding are in 15 business days.

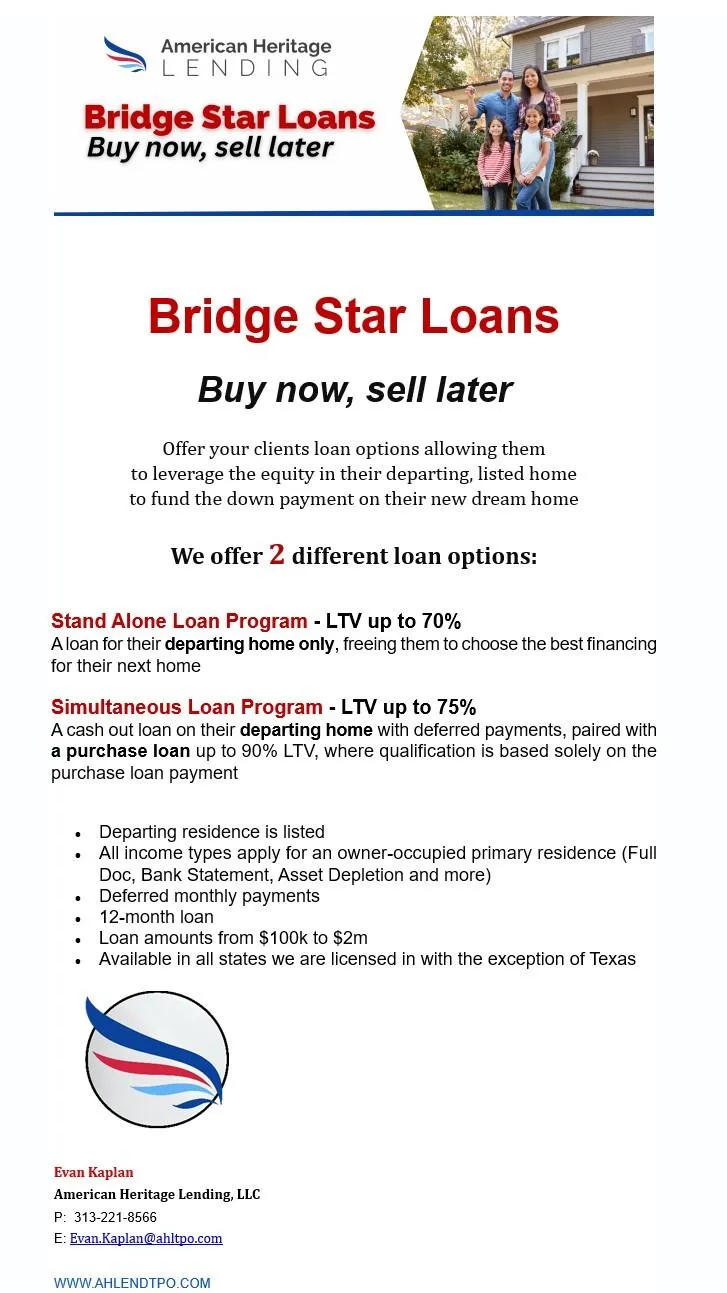

Evan Kaplan

American Heritage Lending, LLC

P: 313-221-8566

E: [email protected]

WWW.AHLENDTPO.COM

The do cash out on departing and the purchase

70-75% on departing loan, cash out bridge loan that pays off existing 1st (9.5% at 2pts)

High priced A paper on purchase, does have an EPO.

Cari Anderson

925-389-4359

[email protected]

AXOS Bank (formerly Bank 0f the Internet)

Portfolio Residential & Commercial Wholesale/Correspondent Lending

No EPO

Cross Collateralization

100% Financing or Bridge

Crazy stuff, call her and she will run the scenario

Bridge to Sale: 60% on departing 12 months(% only) 8.5% 1pt +1pt

5/6 ARM (qual rate 7.5, max dit 55%) on 6.375% 1pt no epo on borrower paid, must qualify

For the high income earners:

Eric Salzwedel

Windsor Mortgage Solutions

P:605.681.2363

F: 605.275.6785

Overview https://www.windsormortgage.com/loan-options/bridge-loans

True Bridge Loan

$250,000 maximum loan amount

$1,500 origination fee.6-month balloon with interest-only monthly payments. Option to renew an additional 6 months for a $2,000 fee.**85% maximum combined loan-to-value (CLTV) ratio. Associated closing costs can be rolled into the bridge and paid out of loan proceeds.

$250,001-$500,000 maximum loan amount****

$2,500 origination fee.Maximum CLTV of 75%.6-month balloon with interest-only monthly payments. Option to renew an additional 6 months for a $2,000 fee

**Associated closing costs can be rolled into the bridge and paid out of loan proceeds.

Max debt-to-income (DTI) ratio of 45%; must include payments for departing residence, bridge loan, and new residence.

Service Providers:

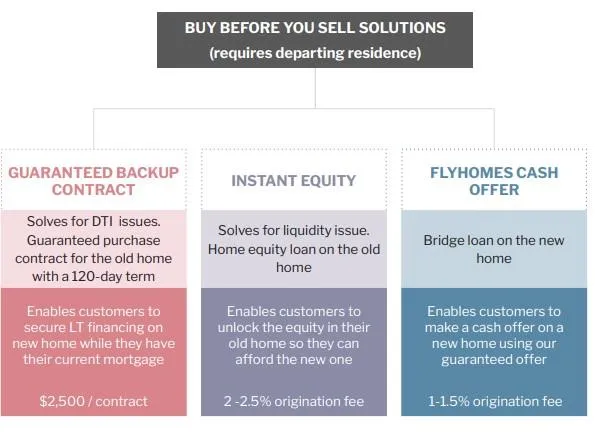

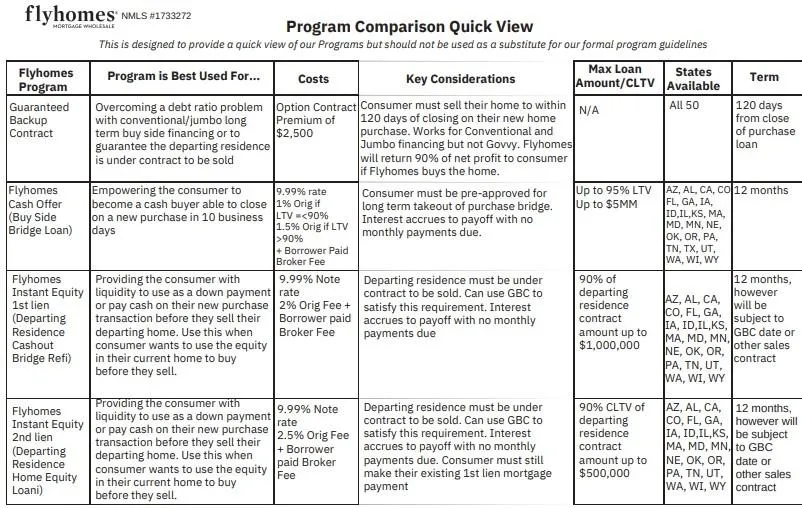

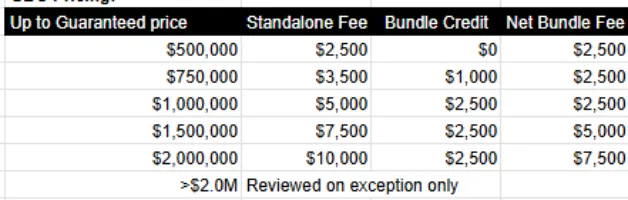

They do the bridge, departing purchase contract...

Greg Notvedt

Account Executive, Mortgage | Flyhomes Mortgage, LLC

641-329-0419

3120 139th Avenue SE, Suite 500, Bellevue, WA 98005

[email protected]

http://www.flyhomesmortgage.com

Submit Your Loan Scenario Here!!

Make your own custom flyers!!

Flyhomes Resource Hub

Flyhomes Mortgagee Clause:

Flyhomes Mortgage, LLC

ISAOA

3120 139th Avenue Southeast, Suite 500

Bellevue, WA 98005

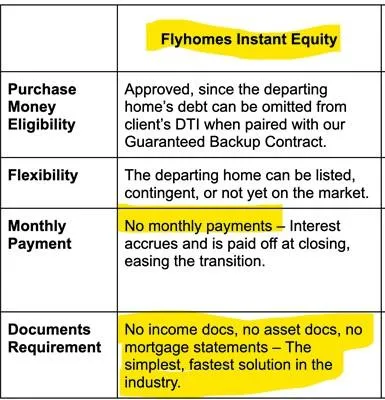

Instant Equity Highlights

No monthly payment: Interest accrues and is paid off when the departing home sells, providing a mortgage payment holiday until the home sells.

The simplest process ever in the industry: No income docs. No asset docs. No mortgage statements for loan approval.

Max total Fees is $20,000

NO EPO

Knock.com

I think they operate like flyhomes

Loan Matrix:

75% max LTV $500,000

2.25% of list price of departing $1,800, no interest rate!

6 months to sell

6 months payment set aside from proceeds

close in 2 weeks

Max list price $2,000,000 on departing residence

homelight.com

Marisa - She works with Barrett

480-864-0865

Inspection costs: $900 + 2.4% of sales price of departing: no interest-no payment

Max of $2,000,000 less first mortgage

70% LTV on departing residence (with assets they can go 80-85% ltv)

120 days from the close of the new house.

AVM & Days on the market and condition of the home.

Remove loan sale contingency

Remove loan debt on departing residence.

Guaranteed offer Equity Unlock Give the agent a vacant listing.

Vacant staged homes sell on average 3% more.

Need 620 credit score

In the last 1,000 only one has been purchased by homelight.

She will do a Zoom training

If the new 1st, is done the loan store, there is a $1,500 referral fee.

UWM will follow these guidelines.

Other Possible Options - Sent emails asking for info

We can't/don't do these:

They want an NDA signed, Barrett hasn't done it

https://calqueinc.com/

They create a contract and provide the 2nd

Rebekah Lanning

National Account Manager

Office: 512.368.9198

https://www.catapult.homes/